Chỉ số đánh giá

XM

Thông tin liên hệ

| Belize | [email protected] |

| +501 223-6696 | https://www.xm.com/ |

What is XM?

XM is a reputable forex broker established in 2009 by Trading Point Holdings Ltd. With a team of over 600 experienced professionals, XM has built a strong reputation in the global financial market. The platform supports trading on a wide scale, serving clients from 196 countries and offering support in more than 30 languages—ensuring convenience and professionalism in its services.

XM is known for its advanced trading tools and over 25 flexible deposit and withdrawal methods. It is one of the leading trading platforms, suitable for both new and professional investors.

| Name | HFM (HotForex) |

| Year Established | 2010 |

| Licenses | CYSEC, FCA, DFSA, FSA (Offshore) |

| Country/Region of Registration | Cyprus |

| Trading Products | Forex, commodities, metals, bonds, energy, ETFs, indices, cryptocurrencies, stocks |

Biểu phí

| Minimum Initial Deposit | $/€ 5 |

| Leverage | 1:888 |

| Base Currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| Trading Platforms | MT4, MT5, XM WebTrader |

| Payment Methods | Internet Banking, Visa/Mastercard, Neteller, Skrill, WebMoney… |

| Trading Fees | 0 |

| Margin Trading | Available |

Ưu điểm / Nhược điểm sàn XM

Ưu điểm

- A diverse range of financial instruments to operate with.

- Offers popular platforms such as MT4 and MT5, as well as its own WebTrader.

- Demo accounts are available for practice before trading with real money.

- Provides educational materials like market analysis, economic calendars, and courses.

- 24/7 customer support via live chat, email, and phone.

Nhược điểm

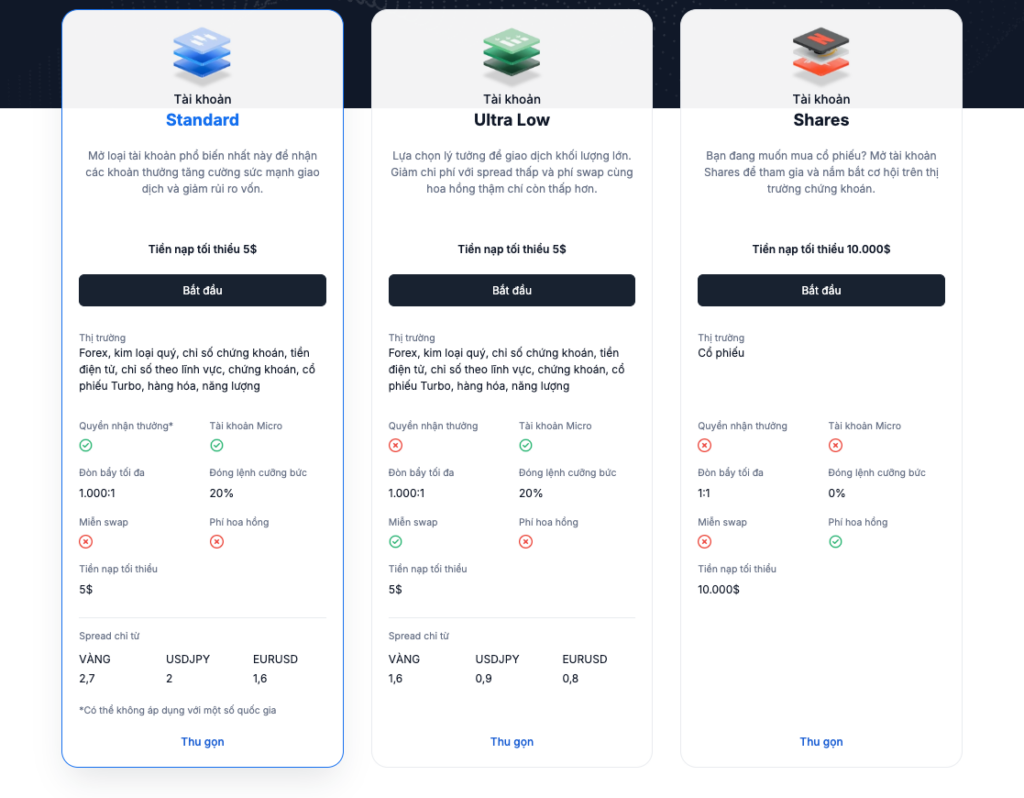

- The minimum deposit of $10,000 for the Share account can be challenging for some traders.

- Spreads on the Standard account are higher compared to other brokers.

- Trading fees apply to the Share account.

- The maximum leverage of 1:1000 can increase risks for inexperienced traders.

When it comes to XM, I can’t help but recall the journey of over 5 years that I’ve spent trading with this broker. From the early days fumbling with a $5 Micro account, to sleepless nights watching EUR/USD, to the joyous moments of profit and the painful margin calls – all of it has been intertwined with XM.

The History and Development of XM

Since its launch in 2009, XM trading platform has steadily grown to become one of the world’s leading forex brokers. Initially, I was skeptical about how a new broker could compete with big names like FXCM, IG Markets, or Saxo Bank. But XM has changed my perspective – and that of millions of traders.

- 2009: XM was founded and quickly built a reputation in the Forex trading industry.

- 2010: Expanded services to include CFD products.

- 2012: Licensed by the Cyprus Securities and Exchange Commission (CySEC).

- 2012 – present: Continued to scale operations, increase client base, and offer more trading products.

Many investors worry about international brokers “holding onto funds” or processing withdrawals slowly. But with XM, I’ve never encountered such issues after over 5 years of trading.

Unlike many brokers that “buy awards” for promotion, XM is recognized by independent financial review institutions:

- Best Global Forex Broker 2024 – CFI.co

- Best Global Customer Service 2024 – CFI.co

- Best FX Service Provider 2024 – City of London Wealth Management Awards

- Best Forex Customer Service 2023 – World Finance Forex

- Best Forex Broker in Europe 2023 – World Finance Forex

- Best Forex Broker in Oceania 2023 – World Finance Forex

As someone who has been observing the markets for over 15 years, I can confidently say:

XM is not just a broker, it’s a transparent, trustworthy, and investor-friendly trading ecosystem.

XM is a reputable trading platform, regulated by major financial authorities such as CySEC, ASIC, and IFSC. However, investors should still exercise caution before entering the Forex market.

Account Types

The main account types offered by XM include Micro, Standard, Ultra, and Share accounts. This variety is designed to meet the needs of different traders, specifically:

- Micro: Designed for beginners with small capital. Similar to FBS or Cent accounts, suitable for those with limited trading experience.

- Standard: Similar to the Micro account but uses standard lot sizing with a maximum leverage of 1:888, suitable for new traders starting out.

- Ultra Low: Meant for professional traders requiring a higher initial capital. Competes with top-tier brokers like ECN, ICMarkets, Exness, etc., and offers many attractive benefits. Ultra accounts are available in Standard and Micro types, differing in trade volume sizes.

- Share: This account is tailored for stock traders, requiring a minimum deposit of $10,000 and does not support leverage. To trade 1 lot, you need $100,000, which implies a leverage of 1:20.

Personal Review: The Ultra Low Spread account is a “great value” option if you enjoy scalping or trading news events. I often use the Ultra account to trade gold due to its super-low spreads and minimal slippage during volatility.

You can check out the XM account opening guide to choose the right investment account!

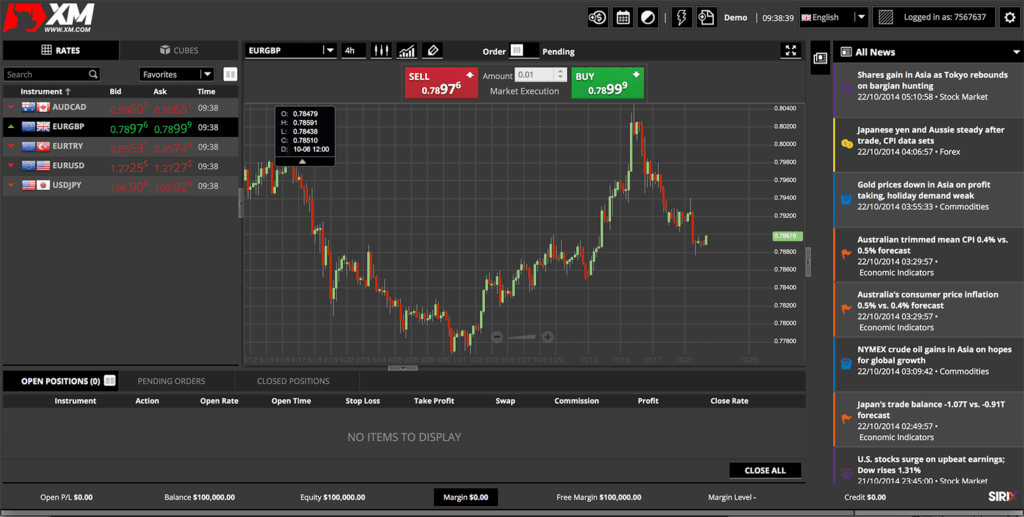

What Trading Platforms Does XM Offer?

XM doesn’t follow the trend of developing its own platform (which are often buggy), but instead focuses on optimizing well-known, established platforms:

- MetaTrader 4 (MT4): A traditional trading platform widely used by investors.

- MetaTrader 5 (MT5): An upgraded version of MT4 with more advanced features.

- WebTrader: An online trading platform that requires no software installation.

- Mobile App: Allows you to trade anytime, anywhere.

What are XM’s trading fees?

If you’re looking for a “super cheap” broker, XM might not be the absolute lowest in cost, but with spreads from 0.6 pip (Ultra), zero commissions, and no hidden fees, I would say:

XM is one of the most transparent brokers when it comes to fees. I tested withdrawals 5 times a week – all were processed within 24h, never delayed or charged.

Below is a breakdown of XM’s fees:

Spread Fees

- XM spreads are fairly competitive, usually under 0.6 pip for major currency pairs.

- For Standard and Micro accounts, the average spread is about 1 pip.

- Prices are sourced directly from the market, so no requotes occur.

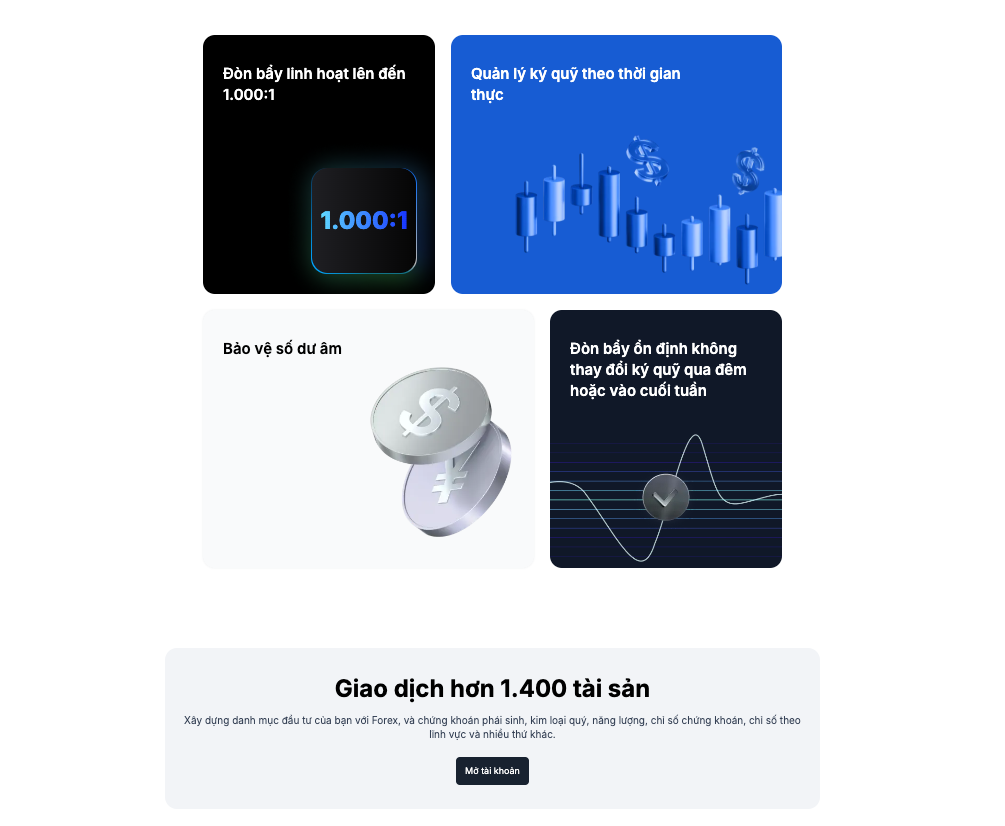

Leverage

XM offers flexible leverage from 1:1 to 1:1000, depending on the account type and capital:

- Ultra Low accounts: $50–$200, or Standard/Micro: $5–$20,000 can access leverage up to 1:1000.

- Accounts from $20,001 to $100,000: leverage is reduced to 1:1 – 1:200.

- Accounts over $100,001: max leverage is 1:100.

- Share accounts: leverage not applicable.

Commission Fees

- Only Share accounts charge commissions when trading stocks.

- Other account types (Standard, Micro, Ultra Low) are commission-free, offering significant cost advantages to investors.

Thanks to its reasonable fee structure, XM is suitable for both new and professional investors.

Can leverage or margin trading be used on XM?

XM supports flexible leverage and margin trading, with leverage ranging from 1:1 to 1:888 depending on account type and balance:

- Under $20,000: max leverage is 1:888.

- $20,001 – $100,000: max leverage is 1:200.

- Over $100,001: max leverage is 1:100.

- Share accounts: no leverage applied.

High leverage involves high risk. It can amplify profits but also magnify losses. Use leverage responsibly based on your risk tolerance and always apply risk management tools like stop-loss orders.

Margin trading requires a solid understanding of how it works. Avoid using all your capital on high-leverage trades to prevent complete losses during market volatility.

FAQ about XM

1. What country is XM from?

XM is an international forex and CFD broker, founded in 2009 and headquartered in Limassol, Cyprus. It operates under the brand of Trading Point Holdings Ltd, registered and based in Cyprus.

2. What documents are needed to become an XM client?

To become a client, you need to provide the following verification documents:

- ID document: Valid national ID card or passport.

- Proof of address: Utility bill or bank statement issued within the last 6 months.

3. What must investors do to verify their XM account?

To verify your XM account, upload your identity and address documents as stated above. Once submitted, XM will review and verify your details within 24 working hours.

4. How long can investors use the Demo account?

The Demo account can be used indefinitely. Investors can practice and test trading strategies without any financial risk.

5. Is XM a reputable broker?

Yes, expert Phạm Hồng Hải from Topforexivet rated XM as a reliable broker regulated by top-tier authorities like CySEC, ASIC, and IFSC. XM is committed to client fund security and adheres to strict investor protection standards. While there are rumors of XM being a scam, these are usually misunderstandings. Some traders lose money due to poor risk management or overusing leverage, mistakenly blaming the broker.

To avoid risks, always study the trading terms carefully and apply strict capital management.

6. Can users lose their bonus? If yes, will they have to return it?

Yes, if users do not meet the minimum trading requirements for the bonus (e.g., trading a required number of lots), XM may revoke the bonus and ask users to return the granted bonus. So be sure to check the promotion terms to avoid losing bonuses.

7. Does XM offer a Cent account?

Yes, XM offers a Micro account which is similar to a Cent account and suitable for traders who want to trade small volumes. Key features of the Micro (Cent) account:

- Currency unit: 1 micro lot = 1,000 base currency units (instead of 100,000 like standard accounts), allowing access to smaller volumes.

- Display currency: Account still shows in USD, EUR, etc., but trade and margin values are smaller.

- Minimum deposit: Starts from just $5, ideal for beginners or those testing trading strategies with low capital.

- Leverage: Flexible from 1:1 to 1:1000.