Chỉ số đánh giá

Ava Trade Markets Ltd

Thông tin liên hệ

| Ireland | |

| +1 212-941-9609 | https://www.avatrade.com |

Giới Thiệu về AvaTrade

| Name | AvaTrade |

| Year Established | 2006 |

| Licenses | ASIC, FSA, FFAJ, ADGM, CBI, FSCA, KNF |

| Country/Region of Registration | Dublin, Ireland |

| Trading Products | Forex, CFDs, stocks, commodities, indices, futures, cryptocurrencies |

Biểu phí

| Minimum Initial Deposit | $100 |

| Leverage | Up to 1:30 (retail) / 1:400 (professional) |

| Base Currencies | GBP, EUR, USD, CHF, AUD, ZAR, JPY and CHF |

| Trading Platforms | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Payment Methods | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Trading Fees | 0 |

| Margin Trading | Available |

Ưu điểm / Nhược điểm sàn AvaTrade

Ưu điểm

- Regulated by reputable financial authorities

- Competitive spreads

- Multiple trading platforms

- Rich and free educational resources

- Access to advanced trading tools and features

- Little to no slippage during high volatility

- Allows automated trading

Nhược điểm

- Unique account options

- High inactivity fees

- Average CFD fees

Choosing a trading platform is a crucial step that can directly impact your investment performance and overall experience. Among countless names in the Forex market, AvaTrade stands out as a platform with solid legal backing, stable technology, and multilingual support—including Vietnamese. But is this broker truly worthy of your trust?

Based on real usage and my experience assisting hundreds of individual investors, I will provide a detailed analysis of AvaTrade’s formation history, credibility, account types, trading fees, platforms, and financial leverage—so you can make a more confident decision.

History and Development of AvaTrade

Founded in 2006, AvaTrade Forex has continuously improved its products and services, delivering the best trading experience to clients.

- 2006: Established in Dublin, Ireland, originally named AvaFX.

- 2009: Renamed to AvaTrade, expanded its offering from Forex to commodities, stocks, and indices.

- 2013: Launched its first mobile app, enabling traders to access markets anytime, anywhere.

- 2015: Won multiple international awards, including “Best Forex Broker.”

- 2018: Added cryptocurrency trading to its product list, starting with Bitcoin, Ethereum, and Ripple.

- 2022: Offered over 1,250 tradable instruments, supporting clients in more than 20 languages.

I’ve encountered many traders using AvaTrade in Europe and Japan—they highly appreciate the platform’s strict compliance with financial regulations from authorities like ASIC (Australia), JFSA (Japan), and the Central Bank of Ireland, which helps protect users’ rights even during times of market volatility.

This broker is expanding rapidly in the Asian market while maintaining its presence in Europe under the supervision of reputable agencies like the **Japan Financial Services Agency (JFSA)** and the **Australian Securities and Investments Commission (ASIC)**. The broker has earned several key licenses:

- ASIC License (Number: 406684)

- FSA License (Number: 2010401081157)

This proves AvaTrade’s credibility and commitment to adhering to international standards. Below are some of the notable awards the platform has achieved:

- Best Forex Trading App Europe 2024 – FX Empire

- Best Forex Broker Colombia 2024 – FX SCOUTS

- Best Online Trading Platform Australia 2024 – Digital Trophy

- Best Partnership Program 2024 – Pan Finance Awards

These accolades highlight Ava-Trade’s strong reputation and ongoing efforts to deliver outstanding trading solutions to clients worldwide.

Account Types

AvaTrade offers three main account types to meet different trading needs:

- Demo Account: A trial account for beginners or anyone wanting to familiarize themselves with AvaTrade’s trading platform. It provides $10,000 in virtual funds for practice without the risk of losing real money.

- Standard Account: Suitable for most traders, especially those new to live trading. This is the most common type, offering full tools and features for trading various asset classes.

- Professional Account: Designed for experienced traders who meet certain conditions such as high trading volume and advanced knowledge. This account offers higher leverage than the Standard account along with exclusive benefits for professional traders.

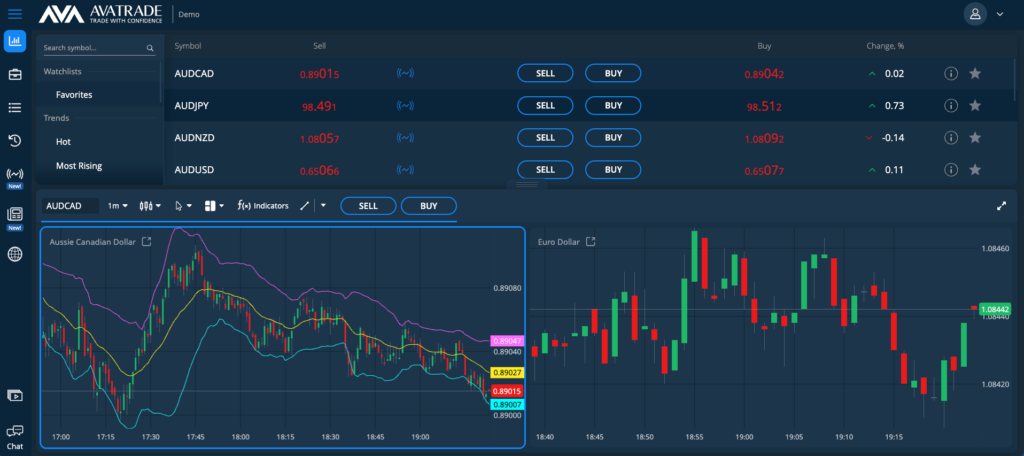

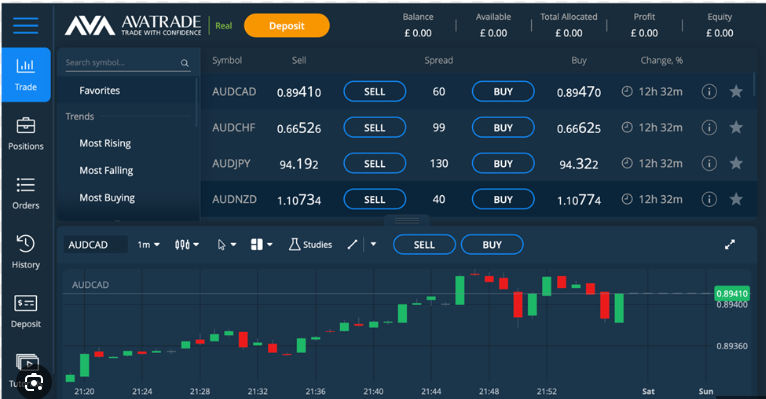

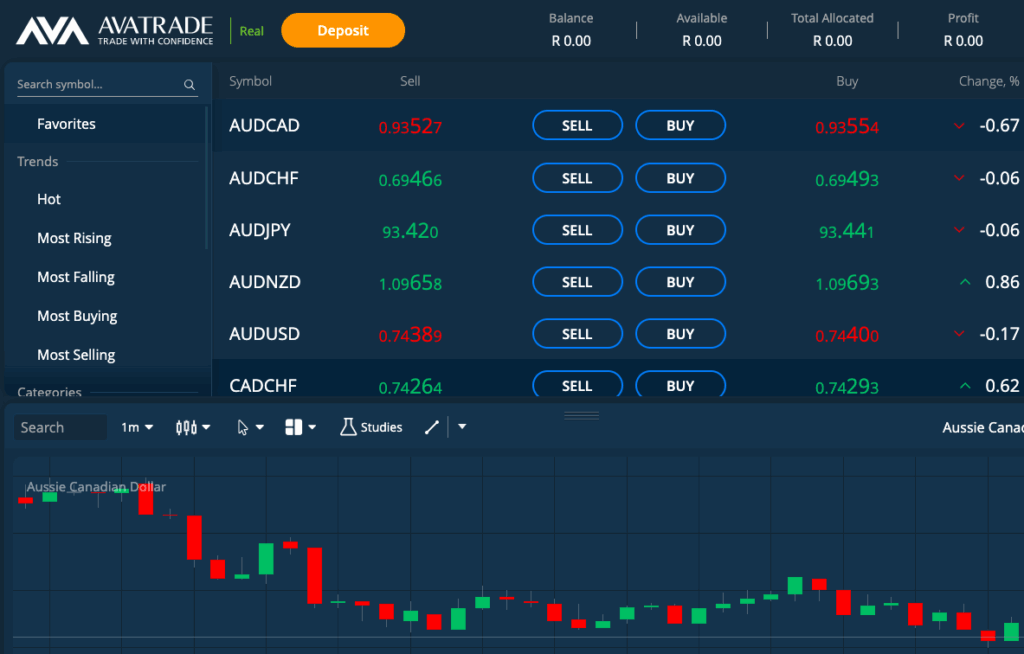

What trading platforms does AvaTrade offer?

The broker provides multiple modern trading platforms:

- MetaTrader 4 (MT4): A popular platform with powerful analytical tools and automated trading via Expert Advisors (EA).

- MetaTrader 5 (MT5): An upgraded version supporting multi-asset trading, multiple timeframes, and advanced technical indicators.

- AvaTradeGO: A proprietary mobile app with a user-friendly interface, making account management simple and efficient.

- WebTrader: Trade directly from your browser without installing any software.

- AvaOptions App: Specifically for options trading, equipped with tools to optimize profit and manage risk.

- AvaSocial: A social trading platform developed by Ava-Trade, offering a unique experience that connects traders worldwide. This platform is especially ideal for those looking to learn from experts or engage with a trading community.

What are AvaTrade’s trading fees?

AvaTrade’s trading fees are designed to be transparent and suitable for both new and experienced traders:

-

Spread: Floating from 0.9 pips for major Forex pairs. This is the main trading cost, as this broker does not charge commission on most trades.

-

Overnight fee (Swap): Charged when positions are held overnight. The fee depends on the asset and trade direction. Islamic accounts are exempt from this fee.

-

Inactivity fee: A monthly fee of $50 applies after 3 months of no trading activity. This helps maintain account infrastructure.

-

Withdrawal fee: No internal withdrawal fees, but external processing fees may apply depending on the payment method used (e.g., credit card, wire transfer, e-wallet).

Overall, this broker offers a competitive and clear fee structure, especially for traders who are active and manage positions regularly.

Can you use leverage or margin trading on Ava Trade?

AvaTrade supports margin trading with different leverage levels depending on asset type and region:

- Forex: Maximum leverage of 1:400.

- Stocks: Maximum leverage of 1:20.

- Cryptocurrencies: Maximum leverage of 1:2.

- Commodities and indices: Maximum leverage of 1:200.

On the Ava-Trade platform, you can use leverage when trading products such as CFDs (Contracts for Difference) and Forex. Leverage allows you to control a larger position with a smaller amount of capital, which can increase potential profits. However, leverage also means that the risk of loss may increase accordingly.

Mr. Pham Hong Hai, CEO of Orient Commercial Bank (OCB) and a financial expert at Topforexviet, has emphasized that using financial leverage in trading can yield high returns but also carries significant risks. Even small market fluctuations can heavily impact your margin.

Frequently Asked Questions

1. Is Ava Trade a reputable broker?

Yes, the broker is licensed and regulated by reputable financial authorities such as ASIC, the Central Bank of Ireland, and the FSCA.

2. What products can I trade on AvaTrade?

This platform offers over 1,250 products, including Forex, stocks, commodities, indices, ETFs, and cryptocurrencies.

3. What are the deposit/withdrawal methods on AvaTrade?

You can deposit/withdraw funds via credit card, bank transfer, or e-wallets like Skrill and Neteller.

4. Does Ava Trade offer a demo account?

Yes, the demo account provides $100,000 in virtual funds for free practice trading.

5. How is leverage applied on AvaTrade?

Leverage is applied depending on the asset type and region, with a maximum of 1:400 for Forex.

6. What languages does Ava Trade support?

The platform supports over 20 languages, including Vietnamese, and has a dedicated customer support team.

This article is shared by expert Pham Hong Hai – a seasoned financial specialist with over 15 years of experience in banking, investment, and Forex trading. He formerly held the position of Head of Financial Markets Division at OCB Bank and was one of the pioneers in developing professional training systems for individual investors in Vietnam.